1 The ruling addresses taxation of payments made by employers with respect to new employees and clarifies taxation of employer-provided mobile devices and. Public Ruling Currently selected.

Pdf Politically Connected Boards In Malaysian Public Listed Companies

A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia.

.png)

. 62017 Date Of Publication. A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia. INLAND REVENUE BOARD OF MALAYSIA BASIS PERIOD FOR A BUSINESS SOURCE FOR PERSONS OTHER THAN A COMPANY LIMITED LIABILITY PARTNERSHIP TRUST BODY AND CO-OPERATIVE SOCIETY 42017 Date of Publication.

DIRECTOR GENERALS PUBLIC RULING Section 138A of the Income Tax Act 1967 ITA provides that the Director General is empowered to make a Public Ruling in relation to the application of any provisions of the ITA. 52017 INLAND REVENUE BOARD OF MALAYSIA TAXATION OF REAL ESTATE INVESTMENT TRUST OR PROPERTY TRUST FUND Public Ruling No. 122017 APPEAL AGAINST AN ASSESSMENT AND APPLICATION FOR RELIEF Public Ruling No.

92017 Date Of Publication. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran. ABC B Sdn Bhd is required to file in STARS and pay the witholding of tax amount of BND 400 within 14 days of the payment date made to ABC S Pte Ltd which the due date is on the 2ndJune 2017.

Check With Expert GST shall be levied and charged on the taxable supply of goods and services. The Finance Act 2017 eliminated the WHT exemption that applied to such services prior to 17 January 2017 but subsequent guidance restored the exemption for services carried out on or after 6 September 2017 as clarified in Practice Note 32017. COMPLAINT.

12 October 2017 Page 1 of 19 1. 12020 of 22 May 2020 on the tax incentives for BioNexus BNX status companies The Public Ruling updates and replaces the prior public ruling on the tax incentives Public Ruling No. 8 September 2017 Published by Inland Revenue Board of Malaysia Third edition Second edition on 19 June 2015 First edition on 26 November 2012.

012017 which sets out the interpretation of the Director General of Customs for the application of the Goods and Service Tax Act 2014 in relation to the imposition of penalty on tax paid after due date. DIRECTOR GENERALS PUBLIC RULING Section 138A of the Income Tax Act 1967 ITA provides that the Director General is empowered to make a Public Ruling in relation to the application of any provisions of the ITA. A Public Ruling is published as a guide for the public and officers of the Inland Revenue.

A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia. Updates and Amendments 41 24. Outside Malaysia on or after 692017 39 22.

Issues a Public Ruling No. 112017 Translation from the. Relevant Provisions of the Law.

52017 Date of Publication. TaXavvy Issue 4-2017 4 Guideline for submission of tax estimates under Section 107C of the Income Tax Act 1967 The IRB has recently issued the operationalguideline GPHDN 12017 dated 23 February 2017 which explains the procedure for submissionof tax estimates under section 107C of the Income Tax Act 1967 ITA for the following categories of. 20 July 2017 Published by Inland Revenue Board of Malaysia Second edition.

The Malaysian Inland Revenue Board MIRB has issued Public Ruling 52019 on Perquisites from Employment on 19 November 2019. Objective The objective of this Public Ruling PR is to explain the a income received by a non-resident public entertainer in Malaysia. It sets out the interpretation of the Director General of Inland Revenue in respect of the particular tax law and the policy and procedure that are to be applied.

DIRECTOR GENERALS PUBLIC RULING Section 138A of the Income Tax Act 1967 ITA provides that the Director General is empowered to make a Public Ruling in relation to the application of any provisions of the ITA. PUBLIC ENTERTAINER Public Ruling No. A ruling is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board of Malaysia.

42017 Public Ruling No. 22 December 2017 Published by Inland Revenue Board of Malaysia Second edition First edition on 12 October 2012 2017 by the Inland Revenue Board of Malaysia. 82018 which was issued in October 2018.

AGENCY Browse other government agencies and NGOs websites from the list. 92017 INLAND REVENUE BOARD OF MALAYSIA REINVESTMENT ALLOWANCE PART 1 MANUFACTURING ACTIVITY Public Ruling No. B deduction of tax from income received by a non-resident public entertainer.

Payment has been made to ABC S Pte Ltd on the 19thMay 2017 at BND 3600 after taking into account the witholding of tax. View PR_11_2017_RESIDENCE_STATUSpdf from PR 11 at Tunku Abdul Rahman University. 29 December 2017 Published by Inland Revenue Board of Malaysia Second edition First edition on 22 October 2015 2017 by Inland Revenue Board of Malaysia.

To subscribe to GMS Flash Alert fill out the subscription form. The Inland Revenue Board of Malaysia IRBM has issued Public Ruling No. INLAND REVENUE BOARD OF MALAYSIA WITHHOLDING TAX ON SPECIAL CLASSES OF INCOME.

INLAND REVENUE BOARD OF MALAYSIA RESIDENCE STATUS OF INDIVIDUALS PUBLIC RULING NO. INLAND REVENUE BOARD OF MALAYSIA RESIDENCE STATUS OF INDIVIDUALS Public Ruling No. Authorised Economic Operator AEO ASEAN Customs Transit System ACTS Free Zone.

Examination of Transactions 40 23. Customs Duties Exemption Order 2017. EVENT CALENDAR Check out whats happening.

The PU order is a supplementary legislation of the Income Tax Act hence why it is child of the PU order whereas the Public Ruling whilst deriving its power from Section 138A of the Income Tax Act 1967 is merely an interpretation of the Income Tax Act and a lawyers job is to always dispute on interpretation of the law. REGISTER LOGIN GST shall be levied and charged on the taxable supply of. The objective of this public ruling pr is to explain the tax treatment accorded to a person in respect of goods and services tax gst paid or to be paid as a input tax on the purchase or acquisition of goods and services other than capital assets by a person if he is registered or liable to be registered under the goods and.

The objective of this Public Ruling PR is to explain the income tax treatment on goods and services tax GST that is the output tax accounted for and borne by the employer on goods or services given free to its employees as a benefit. Year 2017 USA Malaysia USA Malaysia USA 59 days 122 days 31 days 61 days 92 days 306201 7 112017 132017 182017 3092017 31122017. A Public Ruling is published as a guidance for the public and officers of the Inland Revenue Board of Malaysia.

112017 Date of Publication22 December 2017. Superceded by Public Ruling No122017 29122017. DIRECTOR GENERALS PUBLIC RULING Section 138A of the Income Tax Act 1967 ITA provides that the Director General has the power to make a Public Ruling in relation to the application of any provision in the ITA.

122017 INLAND REVENUE BOARD OF MALAYSIA Date of Publication.

Five Public Rulings Updated And One New Public Ruling Issued By The Inland Revenue Board Ey Malaysia

Media Resources Downloads Pembangunan Sumber Manusia Berhad Exemption Of Levy Order 2001 Kwsp 3rd Schedule 7 For Period Apr 2020 To December 2020 Gst Income Tax Forms Gst Forms Epf Kwsp Forms Socso Perkeso Forms News

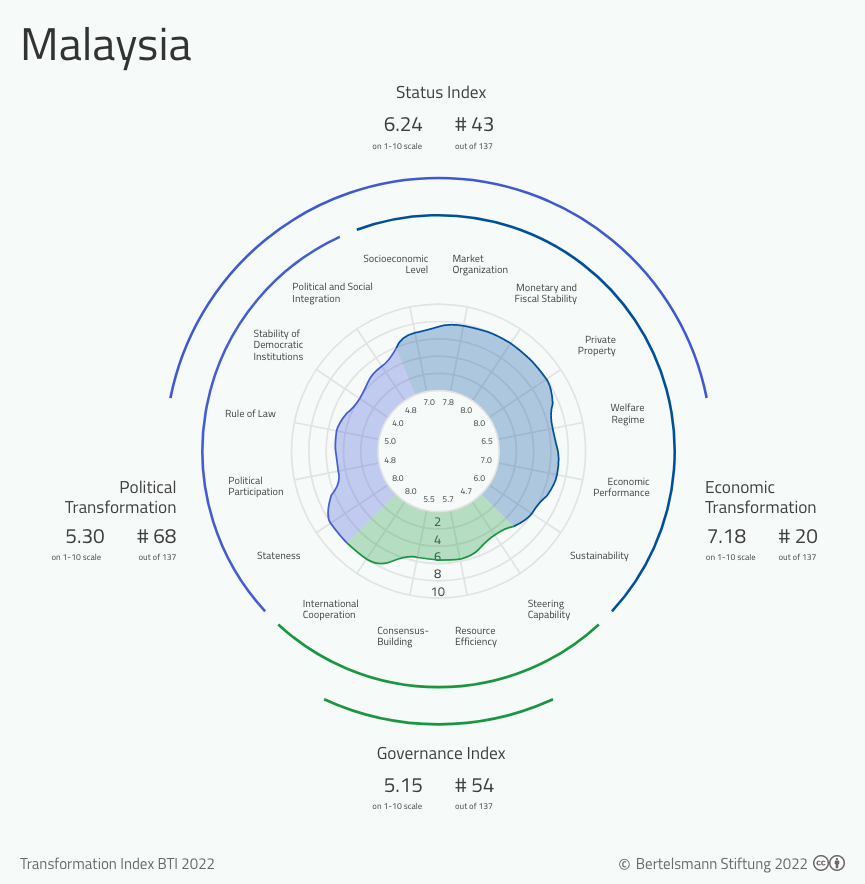

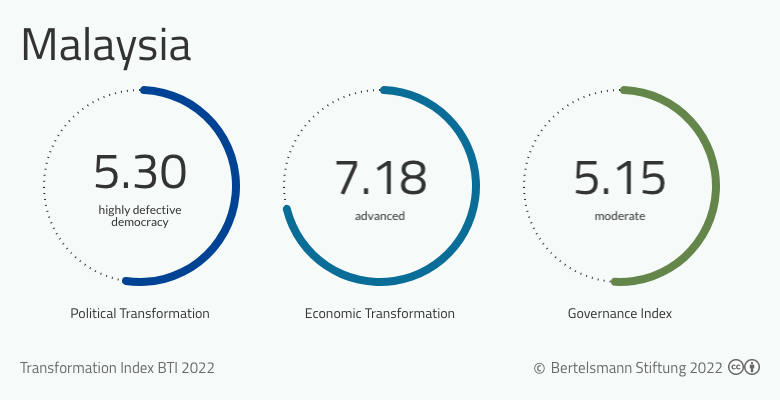

Bti 2022 Malaysia Country Report Bti 2022

Media Resources Downloads Pembangunan Sumber Manusia Berhad Exemption Of Levy Order 2001 Kwsp 3rd Schedule 7 For Period Apr 2020 To December 2020 Gst Income Tax Forms Gst Forms Epf Kwsp Forms Socso Perkeso Forms News

For Malaysia S Ruling Coalition The Honeymoon S Over

Situation Of Lgbt People In Malaysia

.png)